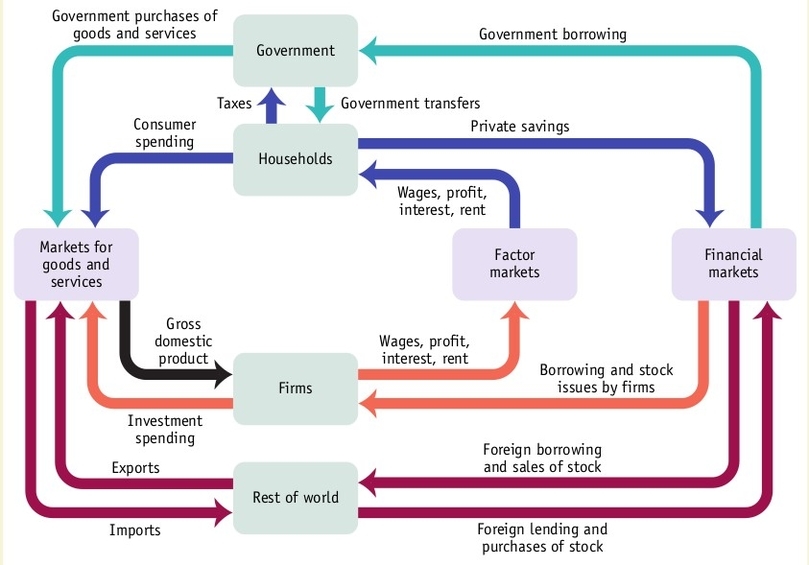

The circular flow of income is a model that shows how money moves in an economy. It involves four sectors: households, firms, government, and foreign. Here is a brief summary of the circular flow of income in a four sector economy:

– Households supply factors of production (such as labor, land, capital, and entrepreneurship) to firms and receive income (such as wages, rent, interest, and profit) in return. Households use their income to buy goods and services from firms, pay taxes to the government, and save or lend some money to the financial sector. Households also receive transfer payments (such as pensions, unemployment benefits, and subsidies) from the government and remittances from abroad.

– Firms use the factors of production from households to produce goods and services. Firms pay income to households, taxes to the government, and dividends or interest to the financial sector. Firms also receive subsidies from the government and borrow money from the financial sector. Firms sell their goods and services to households, the government, and the foreign sector.

– The government collects taxes from households and firms and spends them on public goods and services (such as defense, education, and health care). The government also makes transfer payments to households and subsidies to firms. The government may run a budget surplus (if its revenue exceeds its expenditure) or a budget deficit (if